Some Known Details About Feie Calculator

Table of ContentsAll about Feie CalculatorUnknown Facts About Feie CalculatorNot known Details About Feie Calculator See This Report about Feie CalculatorFeie Calculator Can Be Fun For Anyone

He marketed his U.S. home to establish his intent to live abroad permanently and used for a Mexican residency visa with his spouse to aid satisfy the Bona Fide Residency Examination. Neil points out that getting residential or commercial property abroad can be testing without initial experiencing the location."It's something that individuals require to be really diligent concerning," he states, and recommends expats to be mindful of common mistakes, such as overstaying in the United state

Neil is careful to cautious to Tension tax united state that "I'm not conducting any performing any type of Company. The United state is one of the few countries that tax obligations its citizens no matter of where they live, meaning that even if a deportee has no income from United state

tax return. "The Foreign Tax obligation Credit rating permits people functioning in high-tax nations like the UK to offset their U.S. tax obligation responsibility by the amount they have actually currently paid in taxes abroad," states Lewis.

Feie Calculator Can Be Fun For Anyone

Below are several of one of the most often asked concerns about the FEIE and other exclusions The International Earned Income Exclusion (FEIE) enables U.S. taxpayers to omit approximately $130,000 of foreign-earned income from federal earnings tax, minimizing their U.S. tax obligation. To receive FEIE, you need to satisfy either the Physical Existence Test (330 days abroad) or the Bona Fide Home Test (show your primary residence in an international nation for a whole tax year).

The Physical Existence Test needs you to be outside the united state for 330 days within a 12-month duration. The Physical Presence Test additionally requires united state taxpayers to have both a foreign income and a foreign tax obligation home. A tax obligation home is defined as your prime place for business or employment, no matter your family members's residence.

Getting The Feie Calculator To Work

An income tax treaty between the united state and an additional nation can help stop double tax. While the Foreign Earned Earnings Exclusion lowers gross income, a treaty may supply fringe benefits for eligible taxpayers abroad. FBAR (Foreign Checking Account Record) is a called for filing for united state people with over $10,000 in international economic accounts.

Eligibility for FEIE depends on conference particular residency or physical presence tests. is a tax obligation expert on the Harness system and the founder of Chessis Tax obligation. He belongs to the National Organization of Enrolled Professionals, the Texas Culture of Enrolled Representatives, and the Texas Culture of CPAs. He brings over a decade of experience benefiting Big 4 companies, advising expatriates and high-net-worth people.

Neil Johnson, CPA, is a tax advisor on the Harness system and the founder of The Tax obligation Guy. He has more than thirty years of experience and now concentrates on CFO solutions, equity settlement, copyright taxation, marijuana taxation and separation relevant tax/financial preparation matters. He is an expat based in Mexico - https://www.giantbomb.com/profile/feiecalcu/.

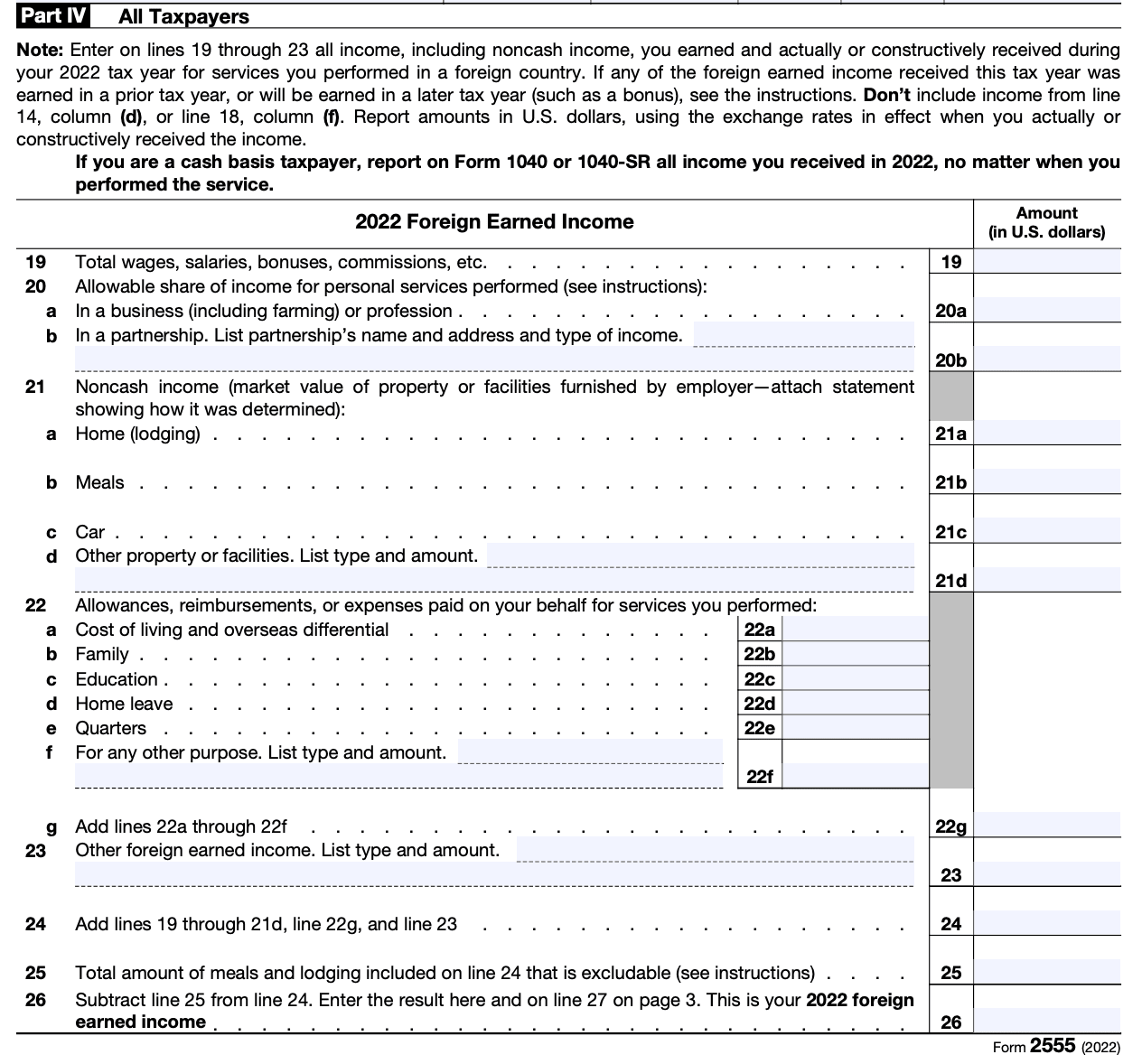

The international made revenue exemptions, often referred to as the Sec. 911 exclusions, leave out tax on salaries made from functioning abroad.

Feie Calculator Things To Know Before You Buy

The earnings exclusion is currently indexed for rising cost of living. The maximum yearly income exclusion is $130,000 for 2025. The tax obligation advantage leaves out the revenue from tax at bottom tax obligation rates. Formerly, the exemptions "came off the top" lowering income based on tax obligation at the leading tax prices. The exemptions might or might not lower earnings made use of for other purposes, such as about his individual retirement account limits, child credits, personal exceptions, and so on.

These exclusions do not spare the incomes from United States taxes yet merely give a tax decrease. Note that a solitary person working abroad for every one of 2025 who made concerning $145,000 with no other earnings will have gross income lowered to absolutely no - successfully the very same answer as being "free of tax." The exemptions are calculated each day.

Comments on “The Buzz on Feie Calculator”